The Phenomenon called “UNICORN”

Woodridgeandscott2022-02-03T14:17:29+01:00Unicorns are privately held startup companies valued at over $1 billion The term was made popular in 2013 by venture capitalist Aileen Lee, choosing the mythical animal to represent the rarity of such successful ventures. there are now 30 unicorns with over $10 billion valuation in the world, They have been given the name “decacorn”.

Unicorns can also refer to a recruitment phenomenon within the human resources (HR) sector. HR managers may have high expectations to fill a position, leading them to look for candidates with qualifications that are higher than required for a specific job. In essence, these managers are looking for a unicorn, which leads to a disconnect between their ideal candidate versus who they can hire from the pool of people available.

In a study done by the Harvard Business Review, it was determined that startups founded between 2012 and 2015 were growing in valuation twice as fast as companies from startups founded between 2000 and 2013. In 2018, 16 U.S. companies became unicorns, resulting in 119 private companies worldwide valued at $1 billion or more.

How Start-ups are able to grow so fast

Fast-growing strategy

Investors and venture capital firms are adopting the “Get Big Fast” (GBF) strategy for startups, known as Blitzscaling. This is a strategy where a startup company tries to expand at a high rate through large funding rounds and price cutting to gain an advantage and push away rival competitors as fast as possible. The rapid returns through this strategy seem to be attractive to all parties involved. However, there is a cautionary note of the lack of long-term sustainability in value creation.

Company buyouts

Most unicorns were created of buyouts from large public companies. In a low-interest-rate and slow-growth environment, many companies focus on acquisitions instead of focusing on capital expenditures and development of the internal investment. Most Startups would rather bolster their businesses through buying out established technology and business models rather than creating it themselves.

Increase of private capital available

The increased amount of private capital available to unicorns has increased three-fold from 2013 to 2015, making it possible for start-ups to embark on buyouts of enormous proportion.

Avoid IPO

Through many funding rounds, Start-up companies do not go through an initial public offering (IPO) to obtain their capital; they can just go back to their investors for more capital. IPOs have the risk of devaluation if the public market disagrees with the valuations, and thinks a company is worth less than its investors.

Technological

Startups are taking advantage of the flood of new technology to obtain Unicorn status. The internet and the access to it by many, to gain massive economies of scale, has enabled startups to have the ability to expand their business faster than ever. New innovations in technology have aided in the growth of unicorns.

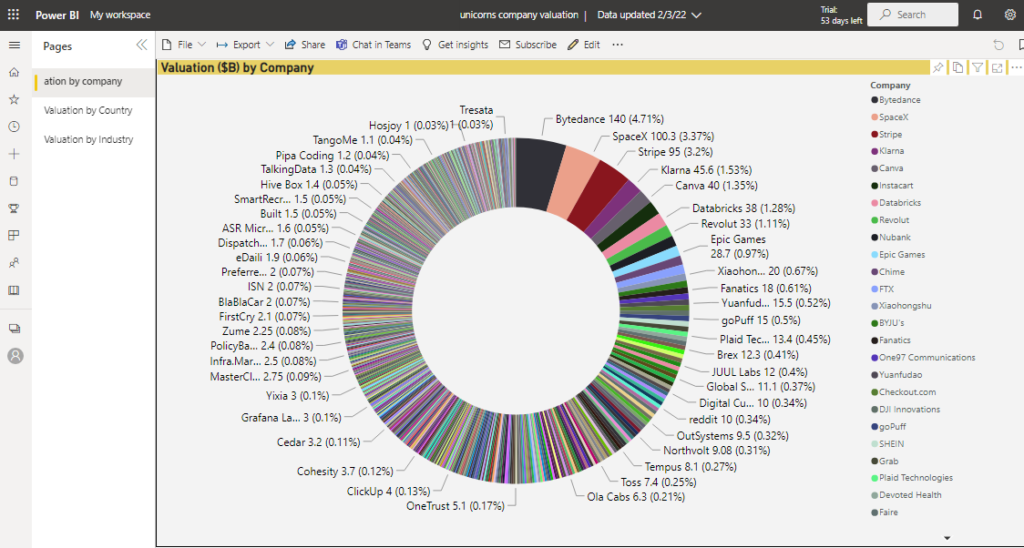

Valuations of Unicorns

The value of unicorns is generally based on how investors and venture capitalists feel they will grow and develop, so it all comes down to longer-term forecasting. This means their valuations have nothing to do with the way they perform financially. In fact, many of these companies rarely generate any profits when they first get running.

When investors/Venture Capitalists of start-up companies are deciding on whether they should invest or not, they look for signs of a home run to make exponential returns on their investment along with the right personality that fits the company. To give such high valuations in funding rounds, investors have to believe in the vision of both the promoters and the company as a whole. They have to believe the company can evolve from its unstable, uncertain present standing into a company that can generate and sustain moderate growth in the future.

To judge the potential growth of a company, the investors need to consider figuring out how large the market really is.

After the market is reasonably estimated, then a forecast can be made to determine how much the company can grow in a certain time period.

Assumptions of where a company can grow to need to be realistic, especially when trying to get investors to give the valuation a company wants. investors know the payout on their investment will not be realized for another five to ten years, but they want assurances that financial forecasts are realistic.

This is where more established valuation methods become more relevant.

- Discounted cash flow analysis

- Market comparable method

- Comparable transactions

Investors can derive a final valuation from these methods and the amount of capital they offer for a percentage of equity within a company becomes the final valuation for a startup. Competitor financials and past transactions also play an important part when providing a basis for valuing a startup and finding a correct valuation for these companies.

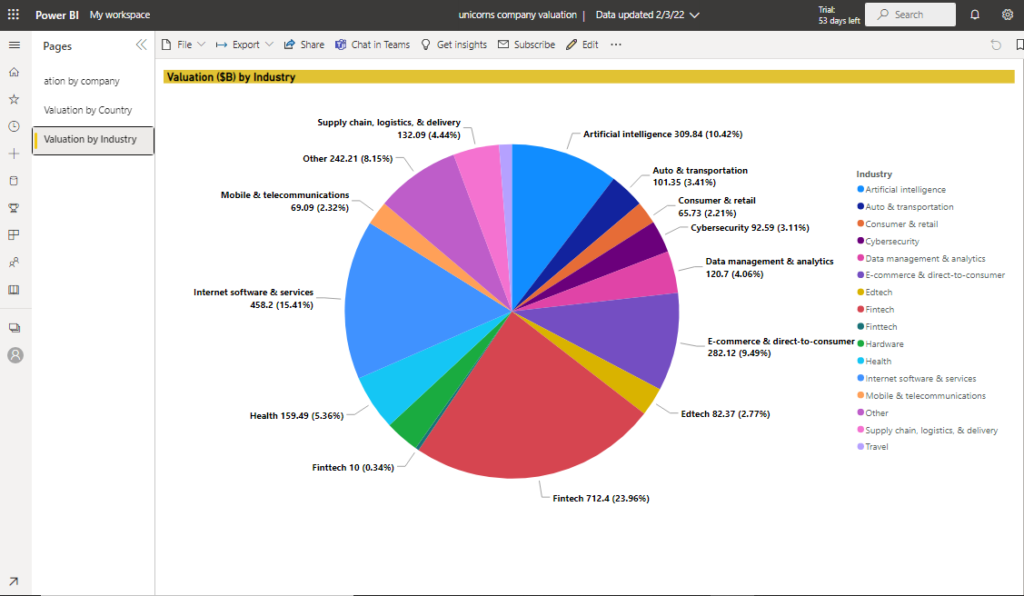

Sharing economy

The sharing economy, also known as “collaborative consumption” or “on-demand economy”, is based on the concept of sharing personal resources. This trend of sharing resources has made three of the top five largest unicorns (Uber, DiDi, and Airbnb) become the most valuable startups in the world. The economic trends of the 2010s powered consumers to learn to be more conservative with spending and the sharing economy reflected this.

Innovative Business Model

In support of the sharing economy, unicorns and successful startups have built an operating model defined as “network orchestrators”.In this business model, there is a network of peers creating value through interaction and sharing. Network orchestrators may sell products/services, collaborate, share reviews, and build relations through their businesses. Examples of network orchestrators include all sharing economy companies (i.e. Uber, Airbnb), companies that let consumers share information (i.e. TripAdvisor, Yelp), and peer-to-peer or business-to-person selling platforms (i.e. Amazon, Alibaba).

Many Nigeria and Africa-focused tech startups have attained unicorn status – a $1 billion valuation for a private company in recent years, these include Jumia Technologies AG, Interswitch, Flutterwave, OPay, and Andela.

Leave a Reply