CFOnow is our Virtual CFO services that give you an on-demand resource to help guide your business, keep your finances under control, and provide you with expert financial knowledge when and as you need it. A full-time Chief Financial Officer can be expensive and may not be fully or effectively utilized in the business.

CFOnow offers many different opportunities to take your business to the next level. From helping you understand the financial health of your business to provide you with valuable financial projections and giving your entire team strategic advice as your business grows. It will provide you with a fully qualified and experienced Chartered Accountant, who has worked for many years as a Group Financial Controller that you can use as a part-time resource in your business to gain the financial expertise that you may be missing in the business at a lower cost.

CFOnow will:

- Explain your financial position: Walk you through your financial statements and discuss profits (or losses), any assets you own and outstanding liabilities as well as your cash flow

- Set up an accounting system and tools: If you have an existing accounting system, then we will evaluate the system and existing process that you have in place and make recommendations for improvement

- Forecast cash flow: Create a 12-month cash flow projection to ensure you have the cash that you need to cover future obligations

- Manage cash flow: Understand where your money is coming from and where you are spending your money

- Create budget-to-actual reports: Set goals for the year and evaluate periodically to see if you are on track to meet your goals; if not, dig into why for example your expenses are higher than you projected

- Work directly with lenders and investors: Act as your liaison by communicating directly with financial institutions and potential investors to provide the financial documents required to show that you are a good credit risk

- Mentoring and training your in-house staff.

Having access to a virtual CFO can be a big benefit for a Small Medium Business. Most SME businesses can’t afford an experienced, knowledgeable CFO on a full-time basis and may never consider hiring one, even when they have accountants that can prepare basic financial reports.

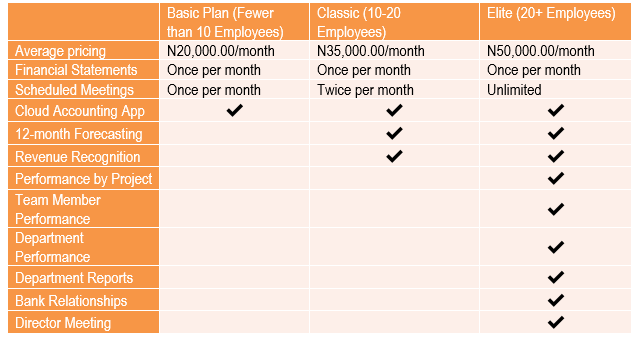

Woodridge and Scott provide alternate solutions to hiring a permanent CFO. Our CFOnow is affordable and gives you more staffing flexibility. Instead of making financial arrangements to hire a permanent CFO, you can contract with us on a Basic, Classic, or Elite basis.

Basic (Transactional)

Woodridge and Scott transactional service consists of preparing your company’s monthly financial reports, unlimited scheduled meetings and an initial onboarding process. The onboarding process consists of our team looking at your books, financial statements (if any) and chart of accounts to gain an understanding of the status of your books. The Basic tier is ideal for a business that has fewer than 10 employees and annual sales are between N5 and N20 million.

Classic (Controller)

Woodridge and Scott controllership service offers a higher, more involved level of service. In addition to full access to our transactional services, we will also manage your company’s cash flow and payroll. Our controllership service level includes budget, bill, and financial account management. We will consult with you by telephone as often as you need, and we will conduct monthly meetings with you in person or through virtual methods. The Controller tier is ideal for a business with 10 to 20 employees and between N20 million to N 40 million in annual sales.

Elite

When you need comprehensive CFO assistance, consider ordering the Elite service. Our team takes care of the same tasks that the CFO of a major corporation completes, which is typically unaffordable for boutique and medium sized operations. Our Elite CFO services include handling your company’s cash flow, preparing profit strategies and developing weekly and monthly predictions for your cash flow needs. Our expertise extends to debt restructuring, and we will be available for monthly meetings either virtually or in person.

Customized Solutions

Whichever solution you choose, we will work closely with you to customize your company’s financial management program. You can keep staffing costs low while still making sure that your company’s accounting and financial matters are handled properly. You will also have cloud based access to your own personalized accounting application, maintained on your behalf by Woodridge and Scott.

Need an Interim CFO? Don’t let the unexpected loss of a key member of your accounting team bring your business to a halt. Woodridge and Scott would be happy to provide one or more well-trained consultants to manage your finances until you can hire new staff.

As interim employees, skilled specialists from Woodridge and Scott can serve in the capacity of Chief Financial Officer, accountant, controller, treasurer, or any combination of these positions.

Your interim CFO is ready to roll up their sleeves and get to work. Hire our team to fill a temporary staff vacancy, and when it’s time to transition back to your original or new staff we’ll facilitate a seamless changeover. Alternatively, you may find yourself so pleased with our senior-level accounting services that you opt to retain our services permanently (it’s happened before).